The construction labor market continues to be strong according to the national data, and there is little sign of a recession in our future. But local experiences may vary widely based on the amount of population growth and the economic conditions on the ground.

It’s hard to think about the construction industry labor market without thinking about the Great Recession of 2007-2009. In a recession driven by the bust of a housing market bubble, the construction industry led the way in job losses. In fact, the construction labor market did not recover all the job losses from the Great Recession until late 2019. Job losses in construction were one of the first signs the Great Recession was upon us – they began in late 2007 just as the downturn was taking hold and, in retrospect, they foretold a difficult few years ahead.

Fast forward to 2023 . . . where are we now? Despite indications in mid-2022 that the construction industry was starting to slow down, there is little evidence that this is true. Construction employment has continued to grow unabated through the January 2023 labor market report, and the job opening rate (the share of jobs in the construction industry that are advertised as vacant) remains near record highs. If construction jobs are an omen for a recession, a recession does not appear to be upon us.

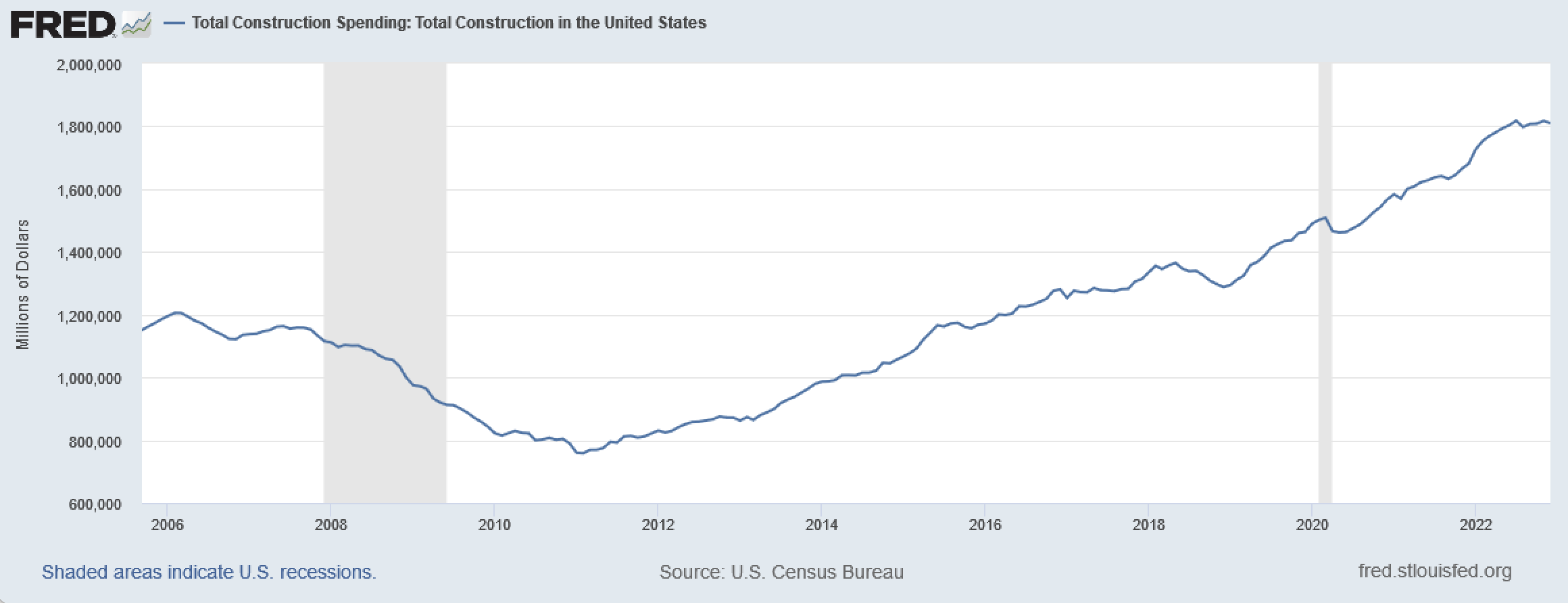

Construction employment remains high because demand for the products the construction industry produces remains high. Observers in this industry often focus on the residential market: how many new houses are being built? With the Federal Reserve’s aggressive interest rate increases of 2022, mortgage rates rose as well. Higher mortgage rates alongside the high cost of housing emerging from the pandemic has reduced the demand for private single family home construction, and new starts for private, single-unit dwellings have fallen by 35 percent since their December 2020 peak.

But single unit residential houses are only part of the story. Other parts of the construction market are booming: construction of multi-unit housing (e.g., apartment buildings) continues to hover near its pandemic peak, and commercial, non-residential, construction projects are absolutely booming. In 2022, new nonresidential building construction projects (known as “starts”) were 38 percent greater than in 2021 according to analysis from Dodge Data & Analytics. Just to put it in perspective, nonresidential construction spending in the United States averaged $837 billion per month in 2019. For the last three months of 2022, that number was $941 billion. These other components of construction spending have fully cancelled out declines in the single unit residential market.

Those are national numbers, but construction markets are highly localized since the product produced cannot be moved from place to place. If Minnesota is booming and Michigan is not, then construction employment in Minnesota is likely to boom, while construction in Michigan will not. This is different than, say, employment in the car manufacturing industry where the local demand for cars is largely irrelevant. It doesn’t matter for Detroit’s auto workers if Michigan or Minnesota has more demand for cars – they service both markets. Construction is the opposite.

Economic growth in the U.S. has become quite uneven in recent years, in part because of uneven migration patterns brought on by the Covid Recession, and also because states’ experiences with Covid and the recovery were uneven. For example, Tennessee had loose Covid restrictions and economic activity slowed down very little and recovered very quickly. At the same time, migration into the state surged. Both of these factors are pushing demand for construction workers higher. On the other hand, states like Pennsylvania were much more aggressive in slowing economic activity in the early months of the pandemic, including shutting down the construction industry. And between 2020 and 2022, the population of Pennsylvania shrank. Demand for construction workers in Pennsylvania is likely quite different than in a place like Nashville, Tennessee.